About Us

Swift Sway Solutions is a global systematic investment manager. Our centralized research focuses on the development of advanced quantitative techniques for uncovering market opportunities and employs them within a disciplined framework that results in efficient exposures.

With a robust infrastructure and talented investment professionals, Swift Sway Solutions offers clients the scale of a large asset management firm, with the benefits of a versatile investment platform – flexibility and customization. Our firm is able to offer institutional and retail investors the essential building blocks for today’s changing investment landscape.

Our Principles and Ambitions

We approach sustainability from three perspectives: an asset owner, an asset manager, and as a company in our own right.

While our responsibilities and obligations in each of these three roles may differ, as we discuss below, our approach in all three is united by a common set of principles and ambitions, set out in the box at the bottom of the page.

We serve as an asset owner on behalf of Prudential With-Profits policy holders, and our pensions and annuity customers. This means we make decisions about how to allocate money to different asset classes and which asset manager should manage our money.

We also have the important responsibility of deciding the financial outcomes we want our asset managers to deliver for us, and the sustainability considerations we require them to apply.

For example, if we think that a certain industry does not have a sustainable future, we may require that the asset manager does not invest in that industry. Our responsibility as an asset owner is to create the best customer outcome in terms of general well-being in line with our fiduciary duty, taking into consideration financial security.

As an asset manager, we must aim to deliver the financial outcomes and any sustainability requirements set out in the objectives of each of our mutual funds, or in the mandates we receive from institutional clients.

Sometimes there may be differences in the sustainability criteria that external clients mandate, and in turn these may differ from the requirements of our internal client.

While our values of care and integrity inform all our sustainability work, the asset manager and asset owner are separately regulated businesses with independent Boards and governance processes, and their policies may diverge on occasion.

Focus

We are focused on global investment strategy. We generally seek to build a concentrated portfolio of scale investments in industries we know well and have developed significant expertise

Culture of transparency

We believe in sharing good (and bad) news early, aligning ourselves with our investors and companies, and truly partnering and empowering management teams. We also don’t charge transaction or monitoring fees to our portfolio companies (and haven’t since our founding)

Commitment to making companies better

We invest for the long haul to support the strategic and financial objectives of outstanding management teams. We believe our deep sector experience allows us to add value and offer insights that enable our companies to flourish.

Industry Insights

Our investment philosophy is enhanced further by the depth of our focus on industry verticals. We have distinguished ourselves as a value-added partner with deep sector insights in select verticals which enables us to take a differentiated approach to sourcing, diligence, and value creation initiatives

Demonstrated performance

We have a clear investment philosophy and disciplined approach to investing and have demonstrated performance across multiple investment cycles over our 10 years history

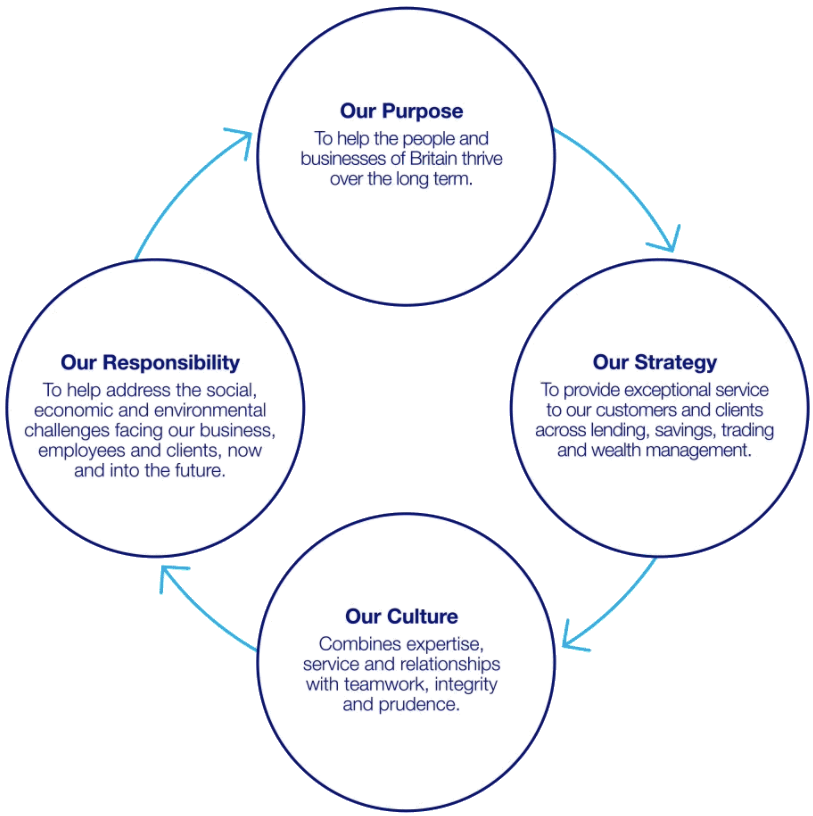

Our Purpose

This means supporting our colleagues, customers and clients, and the communities and environment in which they operate, for the benefit of all our stakeholders. It means helping people and businesses unlock their potential and plan for the future with confidence, building relationships that stand the test of time. And it means that we continue to be there for the long-term, whatever the climate, making decisions that are right for today and for generations to come.

To achieve this, our long-term strategic approach place exceptional service at the heart of everything we do. Each of our diverse, specialist businesses have a deep industry knowledge, so they can understand the challenges and opportunities that our customers and clients face. We support the unique needs of our customers and clients to ensure that they thrive, rather than simply survive, whatever the market conditions.

We believe in putting our customers and clients first. Our cultural attributes bring out the very best of our people, skills and strong reputation that we have built with our stakeholders over many years. A combination of expertise, service and relationships with teamwork, integrity and prudence underpins our approach and gives us the tools to thrive over the long term.

And we recognise that to help the people and businesses of Britain thrive, we also have a responsibility to help address the social, economic and environmental challenges facing our business, employees and clients, now and into the future.

RESPONSIBLE INVESTING AT NUVO LIMITED

We have always believed that we can make a difference in the world through our investments

As a signatory to the United Nations Principles for Responsible Investment (UN PRI), we are committed to the aspirational principles for incorporating ESG considerations into our investment approach.

OUR APPROACH TO ESG AND RESPONSIBLE INVESTING

We believe markets to be largely efficient and strive to provide systematic exposure to certain risk-based and behaviorally driven factors that can be combined intelligently to deliver results for investors.

Our ongoing investment in the research and design of our investment strategies, including ESG-related approaches, seeks to ensure style and returns consistency, while continually evaluating new data, statistics, investment ideas, and quantitative methods.

We have a long history of accommodating client-specific requests and exclusions of certain securities from an investment universe, such as those deemed socially or environmentally undesirable, or operating in regions where human rights abuses are prevalent.

In addition, we are responsible for voting proxies on behalf of clients that have granted the authority to us. We have engaged Institutional Shareholder Services, Inc. (ISS), a third-party proxy voting agent, to provide proxy voting research and execution services on behalf of our clients, while we reserve directive control over ultimate proxy voting. Typically, we follow the ISS Socially Responsible Investing (SRI) Proxy Voting Guidelines.